Smart Combination of Data, Media, Content and Technology

As disruptors, innovators and doers, we’ll always push ourselves to do more for our clients.

With Tug, you get Tug Tools, plus Tug Service.

We quickly get to the heart of our clients’ problems and respond with flexible, bespoke and scalable solutions that don’t just work – they create new opportunities and open doors.

Our Smart Combination approach is a four factor process

Discovery

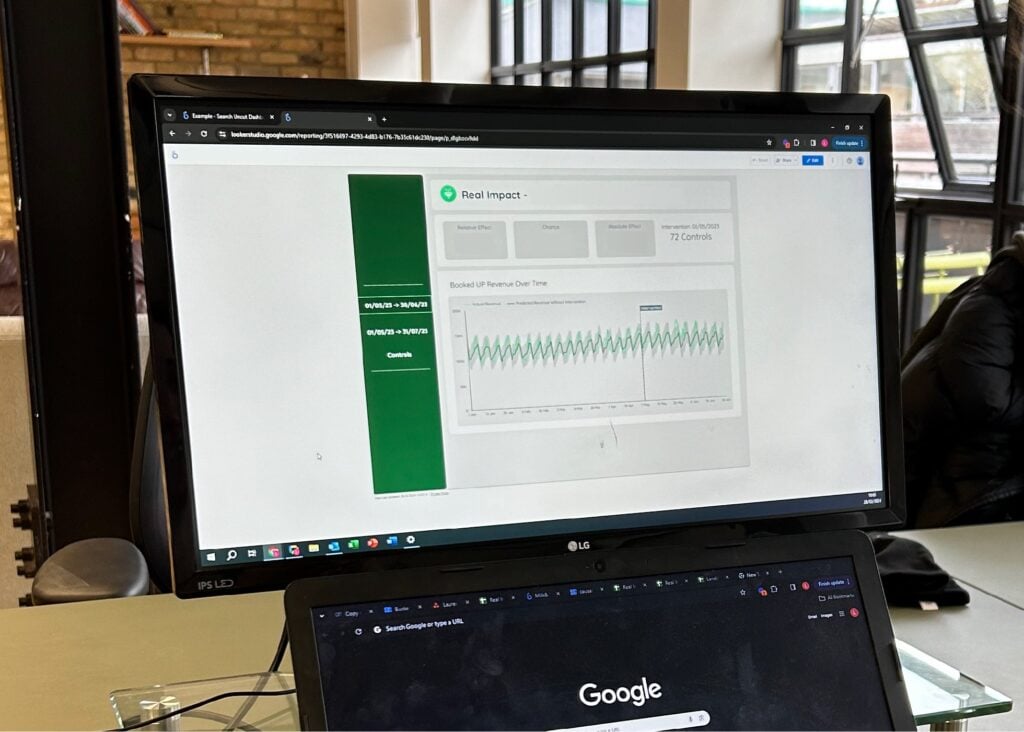

We begin with the discovery, going deeper than other agencies into your data, media, content and technology – looking for those interesting patterns and key markers.

Strategy

Our brilliant basics are top of their game. This is when we start hypothesising on the potential incremental improvements we can make across channels, based on all that rich data.

Build & Launch

Then we build the launch based on the brilliant basics set up. We take the hypothesis our clients have approved, and put together a smart combination testing plan that we use, and learn from.